Navigating the Financial Landscape: Understanding Federal Banking Holidays in 2025

Related Articles: Navigating the Financial Landscape: Understanding Federal Banking Holidays in 2025

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Financial Landscape: Understanding Federal Banking Holidays in 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Financial Landscape: Understanding Federal Banking Holidays in 2025

Federal banking holidays are designated days when most financial institutions, including banks, credit unions, and the Federal Reserve, remain closed for business. These closures are established by the federal government to recognize significant cultural or historical events, allowing employees to observe these occasions while ensuring the smooth functioning of the financial system.

Understanding the schedule of these holidays is crucial for individuals and businesses alike. While these closures may disrupt regular financial transactions, they are essential for fostering a sense of community and commemorating important events.

The Calendar of Federal Banking Holidays in 2025:

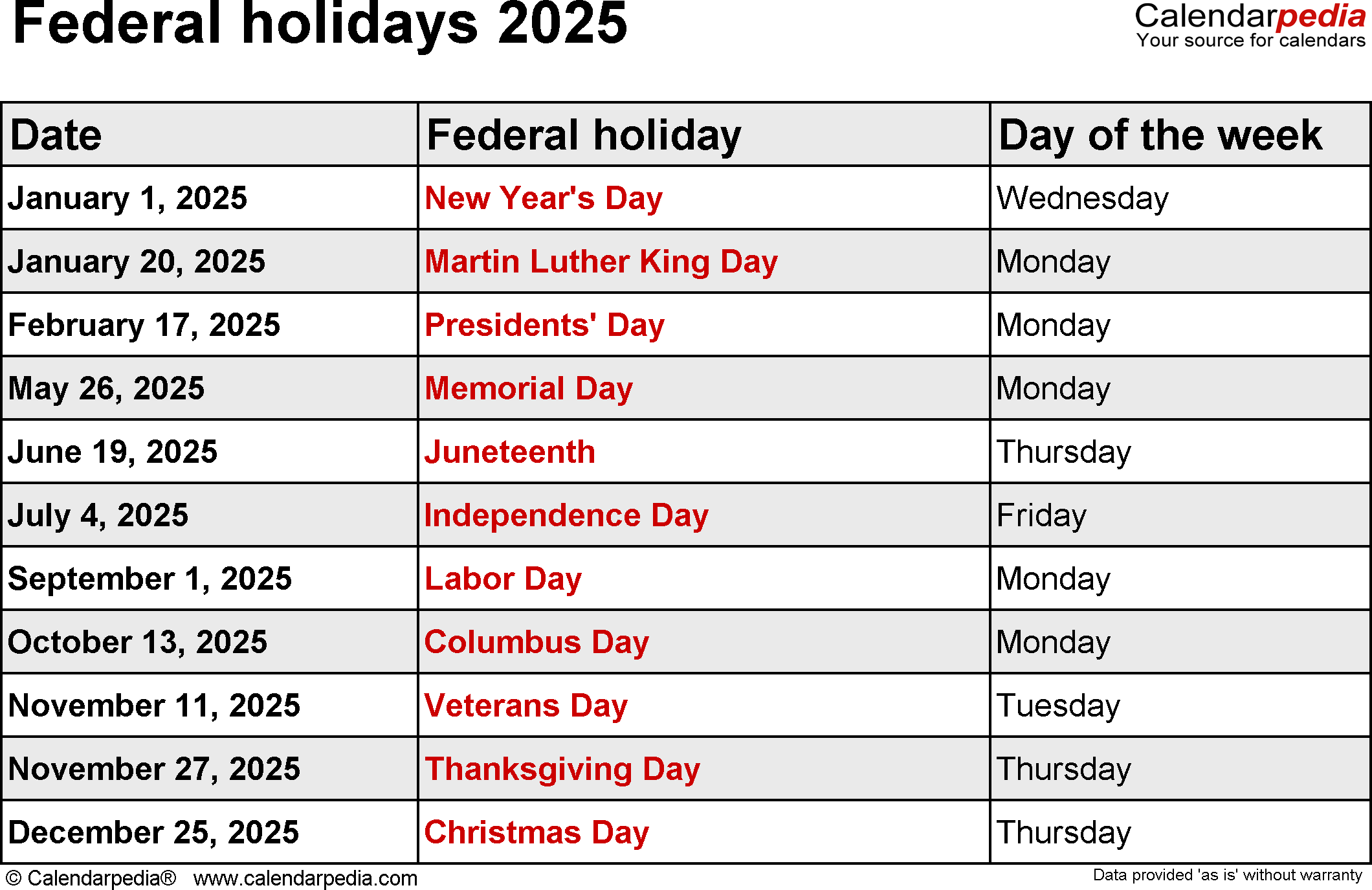

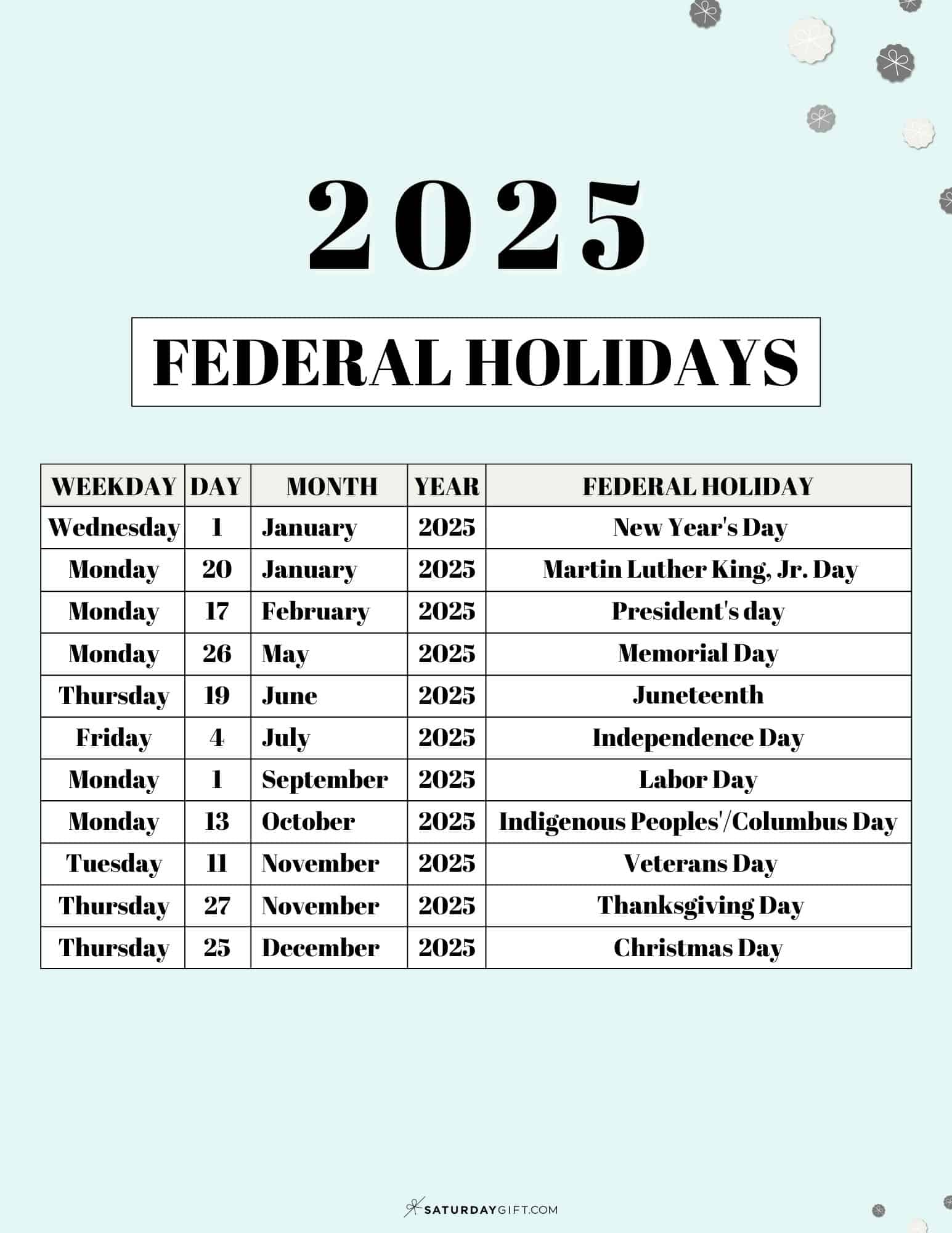

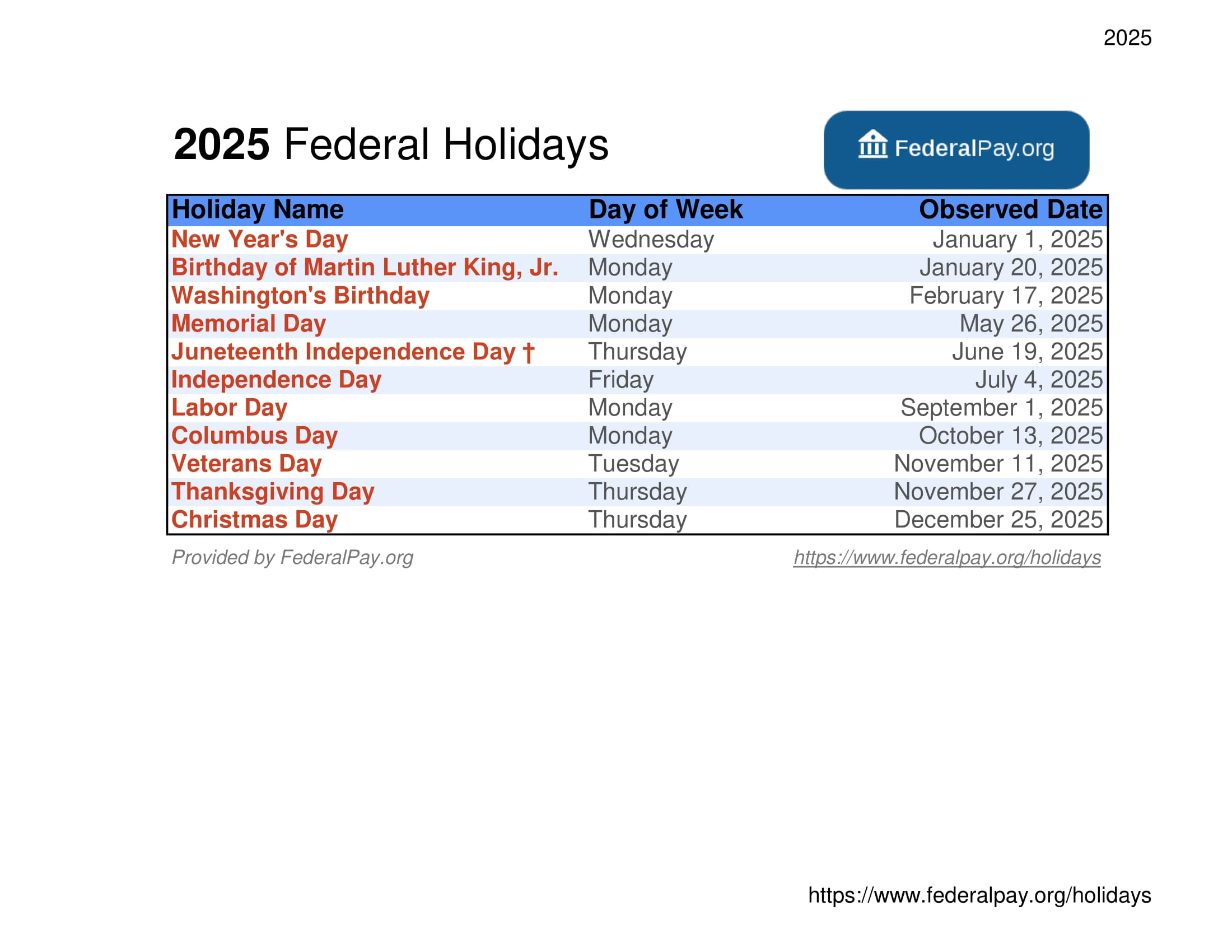

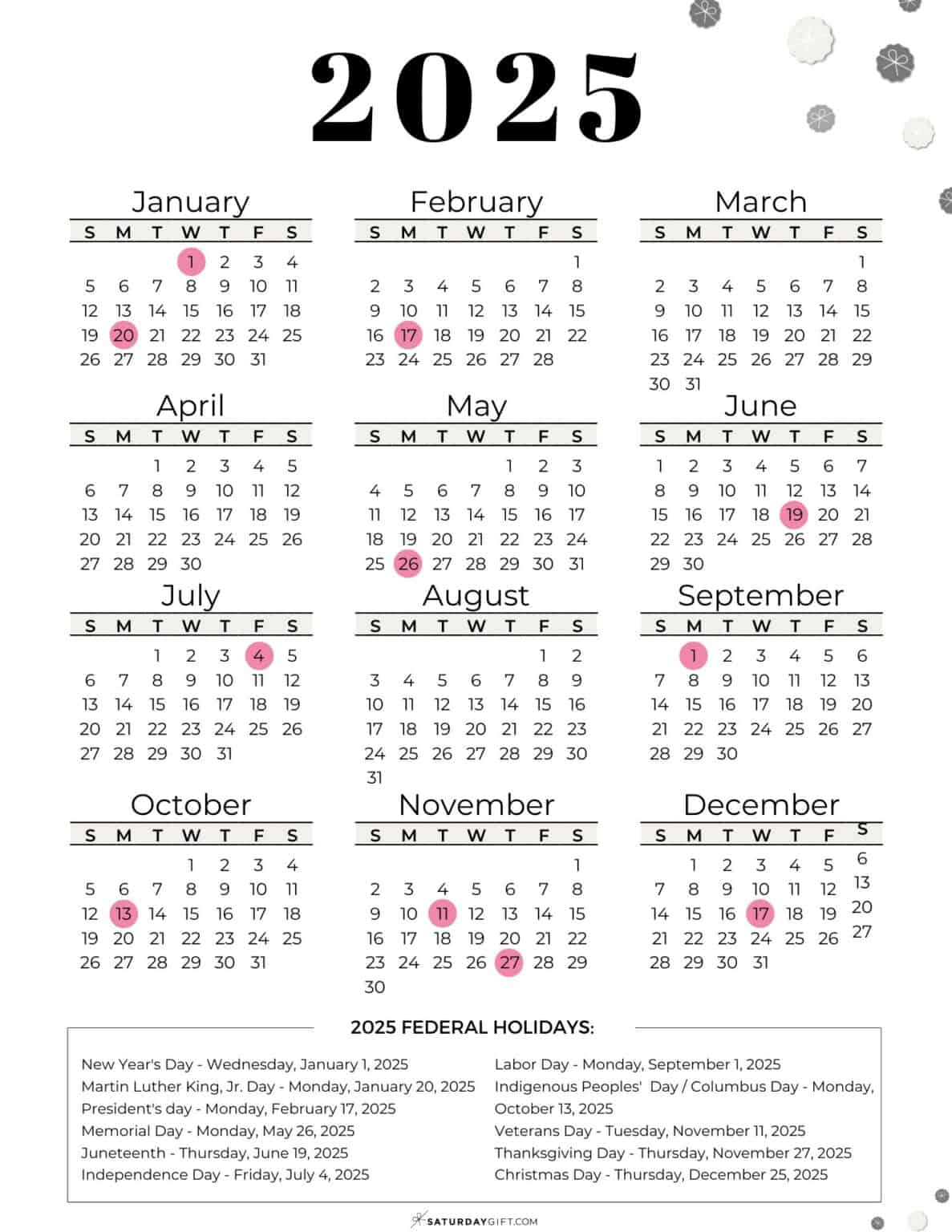

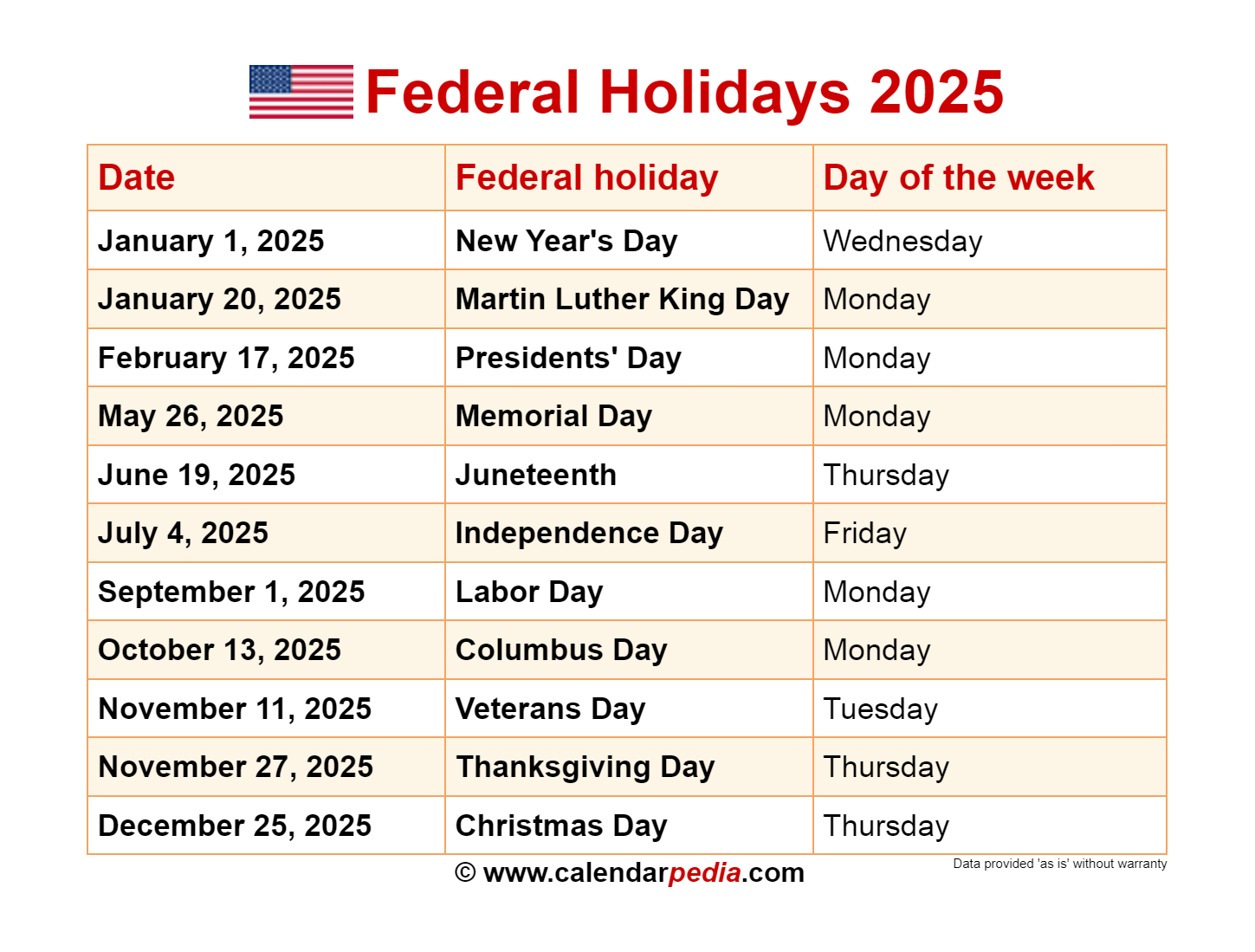

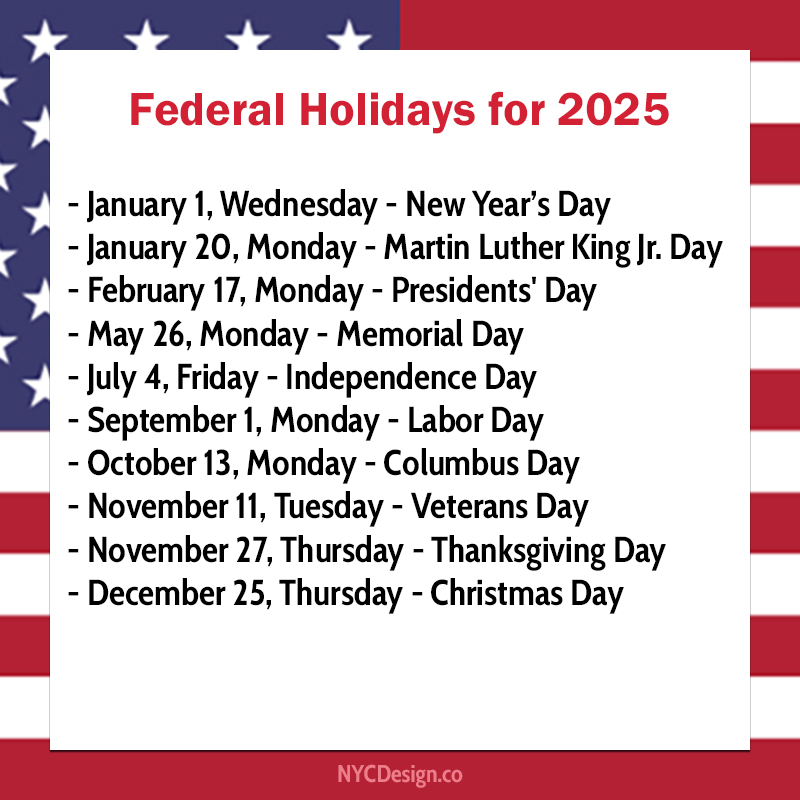

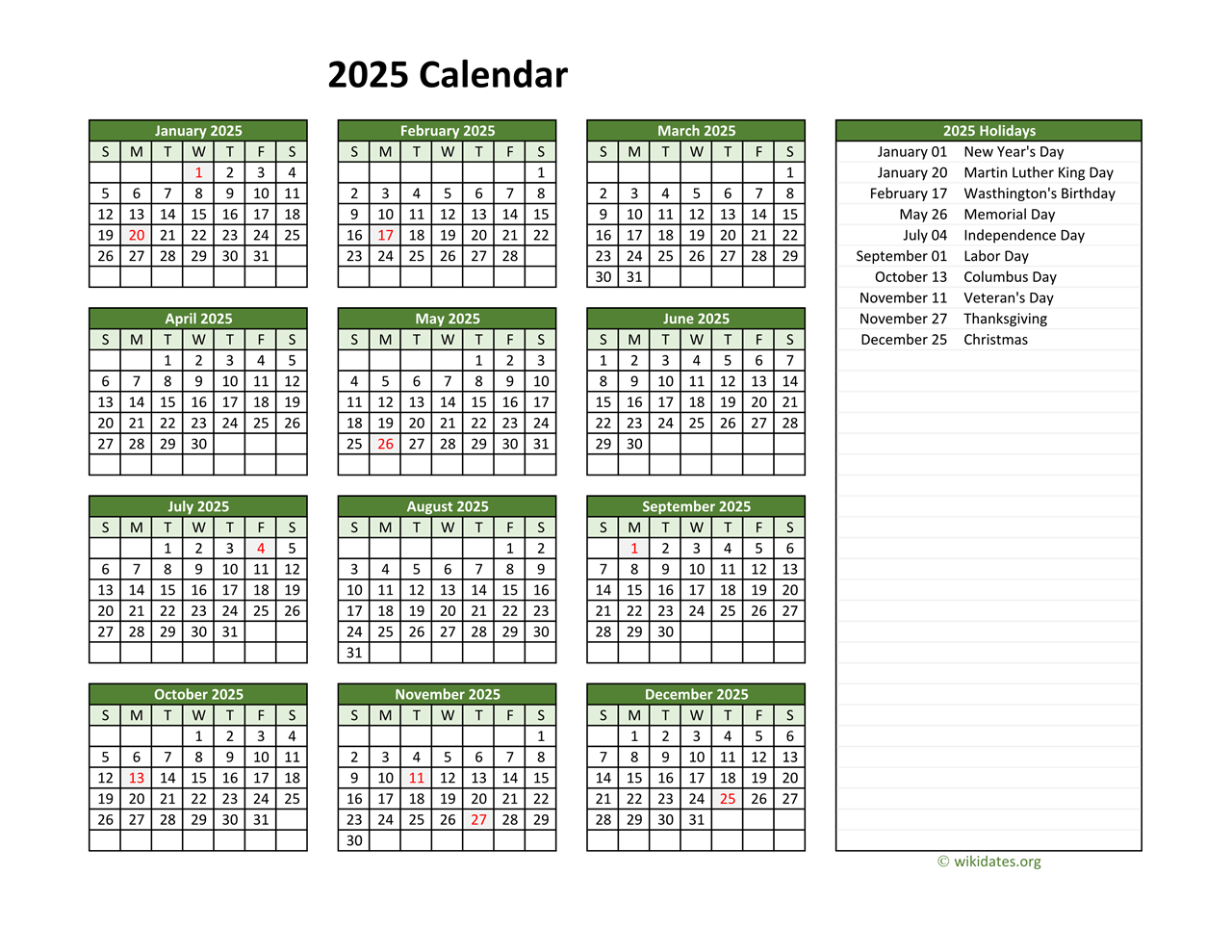

The following is a comprehensive list of federal banking holidays in 2025, outlining their dates and the historical or cultural significance they represent:

-

New Year’s Day: Observed on Monday, January 1st, 2025. This holiday marks the beginning of a new year and is a time for reflection and setting new goals.

-

Martin Luther King Jr. Day: Observed on Monday, January 20th, 2025. This holiday honors the life and legacy of Dr. Martin Luther King Jr., a pivotal figure in the Civil Rights Movement, and celebrates the ideals of equality and justice.

-

Presidents’ Day: Observed on Monday, February 17th, 2025. This holiday commemorates the birthdays of George Washington and Abraham Lincoln, two influential presidents in American history, and serves as a reminder of their contributions to the nation.

-

Memorial Day: Observed on Monday, May 26th, 2025. This holiday honors the sacrifices made by American military personnel who died in service to the country. It is a time for remembrance and gratitude.

-

Juneteenth National Independence Day: Observed on Friday, June 19th, 2025. This holiday marks the emancipation of enslaved African Americans in the United States, commemorating the day in 1865 when Union General Gordon Granger arrived in Galveston, Texas, and announced that all slaves in the state were free.

-

Independence Day: Observed on Thursday, July 3rd, 2025. This holiday celebrates the signing of the Declaration of Independence on July 4th, 1776, marking the birth of the United States as an independent nation.

-

Labor Day: Observed on Monday, September 1st, 2025. This holiday celebrates the contributions and achievements of American workers and recognizes their vital role in the nation’s economic prosperity.

-

Columbus Day: Observed on Monday, October 13th, 2025. This holiday commemorates the arrival of Christopher Columbus in the Americas in 1492, though its historical significance and cultural impact are increasingly debated.

-

Veterans Day: Observed on Monday, November 10th, 2025. This holiday honors all American veterans who have served in the United States Armed Forces. It is a day to express gratitude for their sacrifices and dedication.

-

Thanksgiving Day: Observed on Thursday, November 27th, 2025. This holiday is a time for gratitude and celebration, focusing on family, friends, and the bounty of the harvest.

-

Christmas Day: Observed on Wednesday, December 25th, 2025. This holiday is a religious and cultural celebration of the birth of Jesus Christ, often marked by family gatherings, gift-giving, and festive traditions.

Understanding the Impact of Federal Banking Holidays:

While these holidays provide opportunities for reflection and celebration, it’s important to be aware of their impact on financial transactions:

-

Limited Access to Banking Services: Most banks, credit unions, and other financial institutions remain closed on federal banking holidays. This means limited access to services like deposits, withdrawals, loan payments, and check processing.

-

Delayed Transactions: Payments, transfers, and other financial transactions may be delayed due to the closure of financial institutions. This is particularly relevant for time-sensitive transactions like bill payments or payroll processing.

-

Potential Market Fluctuations: The closure of financial markets on certain federal banking holidays, like Christmas Day, can lead to fluctuations in stock prices and other financial instruments.

Frequently Asked Questions about Federal Banking Holidays in 2025:

-

Q: What happens to my automatic bill payments on a federal banking holiday?

A: Most banks and financial institutions will process automatic bill payments on the next business day following a federal banking holiday. However, it’s always advisable to check with your financial institution for specific guidelines.

-

Q: Are stock markets closed on all federal banking holidays?

A: Not all federal banking holidays result in the closure of stock markets. While the New York Stock Exchange and NASDAQ are closed on most federal holidays, certain holidays like Columbus Day and Veterans Day may not necessarily lead to market closures. It’s essential to refer to the official calendar of the specific exchange for accurate information.

-

Q: Can I still access my money through ATMs on a federal banking holiday?

A: While bank branches remain closed, ATMs are generally operational on federal banking holidays. However, it’s advisable to check with your bank or credit union for any specific limitations or restrictions on ATM access.

-

Q: How can I ensure my financial transactions are processed on time during a federal banking holiday?

A: To avoid delays, schedule your transactions, especially time-sensitive ones, in advance of a federal banking holiday. This includes bill payments, transfers, and any other financial activities.

Tips for Managing Finances During Federal Banking Holidays:

-

Plan Ahead: Anticipate the impact of federal banking holidays on your financial activities and schedule transactions accordingly.

-

Check with Your Financial Institution: Confirm the specific operating hours and service availability of your bank or credit union during federal banking holidays.

-

Use Online or Mobile Banking: Utilize online or mobile banking platforms to access your accounts and perform essential transactions remotely.

-

Use ATMs: Access your funds through ATMs for basic transactions like withdrawals and balance checks.

-

Consider Alternative Payment Methods: Explore alternative payment methods like prepaid cards or digital wallets for transactions during federal banking holidays.

Conclusion:

Federal banking holidays serve as important reminders of our nation’s history and cultural heritage. While they may temporarily disrupt financial transactions, understanding their schedule and taking appropriate steps to manage your finances can ensure a smooth experience. By staying informed and planning ahead, you can navigate the financial landscape effectively, even during these designated closures.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Financial Landscape: Understanding Federal Banking Holidays in 2025. We thank you for taking the time to read this article. See you in our next article!